Are you having trouble qualifying for a small-business loan? Then a CDFI loan may be the right solution for you.

What is a CDFI loan?

A CDFI loan is funding provided by a community development financial institution that finances with the mission of providing fair and responsible lending options to underprivileged, rural, native and other communities who are often not considered for a loan by mainstream lenders.

CDFIs are funded by private sectors that are certified by the U.S. Department of Treasury, the Department of Commerce, traditional banks, religious organizations, corporations, and more. With this, they can access funds for clients without having to worry about credit scores, time in business, or other requirements.

Small-Business Loan Statistics

Recent trends from the Federal Reserve show a considerable drop in small businesses going for traditional loans – down from 43% in 2019 to just 34% in 2021. This is mostly because those who do apply are finding it increasingly more difficult to get the full amount they need.

In 2021, only about a third got the amount that they asked for, a big drop from half in 2019. This is especially true for businesses run by people of color, smaller teams, and those in the leisure and hospitality sector.

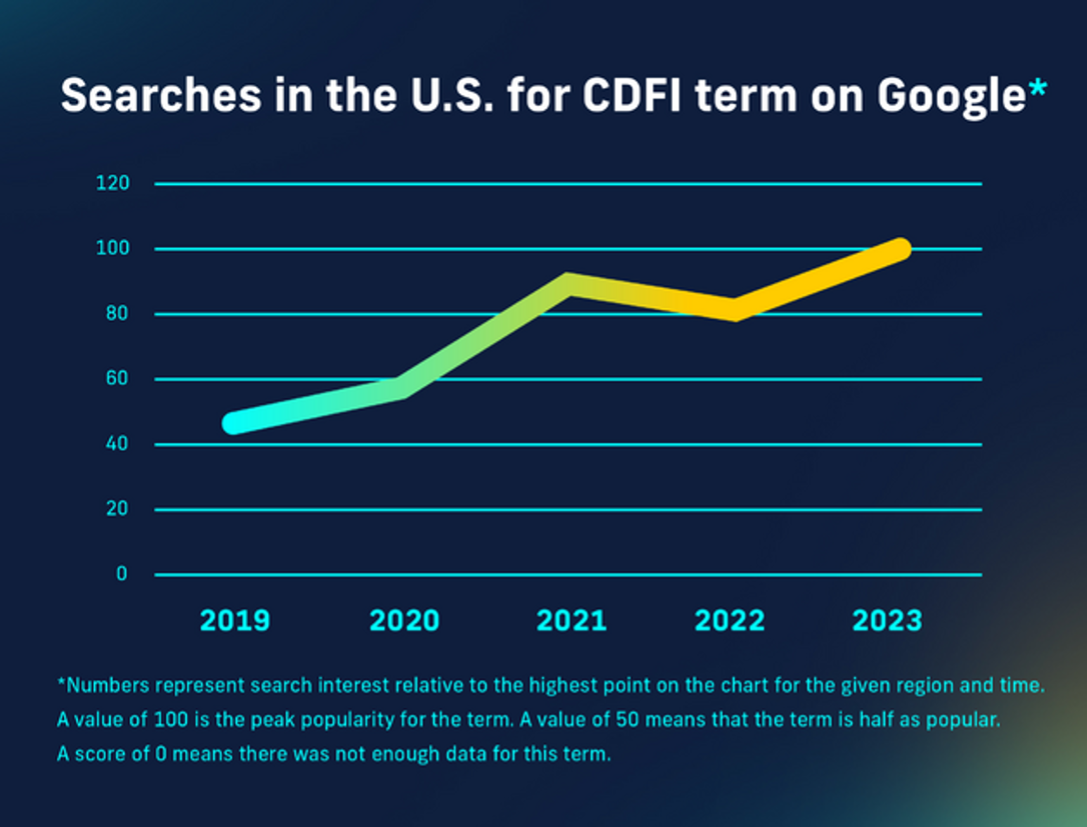

While most still turn to big and small banks for loans, there's a growing interest in online and CDFI lenders, with their use jumping from 20% to 23% in just a year. Though both CDFIs and online lenders fall into the alternative lending category, they're not to be confused. Online lenders usually charge higher rates compared to traditional banks, whereas CDFIs operate with a special approach, not necessarily aligning with conventional banking rates.

Why a CDFI?

For people or small businesses looking for a banking alternative, CDFIs are a valid alternative. Because CDFIs are mostly locally controlled and not subject to national corporate headquarters or federal government nuances, they can support the community without having to factor in shareholders and government. The purpose of a CDFI is to serve the needs of low- and middle-income individuals or businesses that are usually overlooked by traditional finance institutions.

CDFIs all vary in their requirements and often tend to have more slack practices compared to traditional banks. These types of lenders mostly focus on educational outreach and small business lending.

The two types of depository CDFIs are: community development banks and community development credit unions.

- Community development banks are for profit institutions that primarily focus on providing financial aid to economically challenged communities. These institutions keep community needs and concerns in the loop by integrating community members into their board of directors.

- Community development credit unions are similar to traditional credit unions in that they’re not for profit financial institutions and are owned by members. These institutions offer a multitude of services including savings management, asset-building, retail financial services and affordable credit.

Pros of a CDFI Loan:

Higher Approval Chances

- Accion Opportunity Fund provides small businesses with financing options with no minimum credit score requirement and only 3 months in business requirement.

Developmental Aid

- CDFIs offer clients technical and training assistance, mentoring and advisement services.

Cons of a CDFI Loan:

Eligibility

Not everyone is eligible. To qualify for a CDFI, your business must lack resources and/or need financial assistance.

Interest Rates

- CDFI loans qualify individuals based on different criteria compared to traditional banks which can therefore lead to varying interest rates.

- In a July 2023 report by the CDFI Fund of the fiscal year of 2021, it is reported that the CDFI loan interest rates varied anywhere from 4% to 9%, depending on what kind of loan you were after.

Myrna Sonora, regional vice president for Prospera in South Florida, states, “You have to understand that you are more of a risk.”

It’s important to keep in mind that there are risks to any loan you may obtain. A CDFI may come with some contingencies like a higher interest rate, which is the bank’s way of assuring they are protecting themselves. In helping your business succeed and overlooking things like time in business and credit score, banks need an assurance policy that they will be paid back.

Where can I learn more about getting a CDFI loan?

Individuals and small business organizations can find local institutions with the CDFI’s searchable award database or the Opportunity Finance Network’s CDFI locator. You can also reach out to your traditional bank loaner or browse their website for potential CDFI partners.